Running a business means dealing with contracts constantly. Whether you’re signing vendor agreements, employment contracts, or partnership deals, every document that crosses your desk could make or break your business. That’s where contract review becomes absolutely critical.

Most business owners think they can handle contract review on their own. After all, how hard can it be to read through a few pages of legal text? The reality is much more complex. A single overlooked clause can cost you thousands of dollars, leave you legally vulnerable, or tie you into unfavorable terms for years.

We will walk you through everything you need to know about contract review, from the basics to when you should definitely call in a contract review lawyer. By the end, you’ll understand how to protect your business and make smarter decisions about every agreement you sign.

Table of Contents

ToggleWhat Is Contract Review and Why It Matters

Contract review is the systematic process of examining every clause, term, and condition in a legal agreement before you sign it. It’s not just about reading the document, it’s about understanding the legal implications, identifying potential risks, and negotiating better terms when needed.

Think of contract review as your business insurance policy. Just like you wouldn’t skip insurance for your office or equipment, you shouldn’t skip reviewing contracts that could impact your company’s future.

The Real Cost of Poor Contract Review

Consider this scenario: A small marketing agency signs a client contract without proper review. Six months later, they discover a clause that allows the client to terminate the agreement with just 24 hours’ notice, while requiring the agency to give 90 days’ notice. When the client suddenly pulls out of a major project, the agency loses $50,000 in expected revenue overnight.

This isn’t uncommon. Poor contract review leads to:

- Financial losses from unfavorable payment terms or hidden fees

- Legal disputes that drain time and resources

- Operational restrictions that limit business growth

- Liability exposure that puts personal assets at risk

- Missed opportunities due to overly restrictive non-compete clauses

What Makes Contract Review Complex

Modern business contracts aren’t simple handshake deals. They’re complex documents filled with legal terminology that can trip up even experienced business owners. Here’s what makes them challenging:

Legal language complexity: Contracts use specific terms that have precise legal meanings. Words like “material breach,” “force majeure,” or “indemnification” carry weight that goes beyond their common usage.

Hidden implications: A clause that seems straightforward might have far-reaching consequences you don’t see immediately. For example, an “exclusive dealing” clause might prevent you from working with competitors, limiting your revenue potential.

Industry-specific requirements: Different industries have unique contract considerations. A software licensing agreement has completely different risk factors than a construction contract.

Interconnected clauses: Contract terms don’t exist in isolation. One clause can modify or override another, creating a web of obligations that’s hard to track without expertise.

This complexity is exactly why many business owners turn to a contract review lawyer for important agreements. The cost of professional review is almost always less than the cost of contract problems down the road.

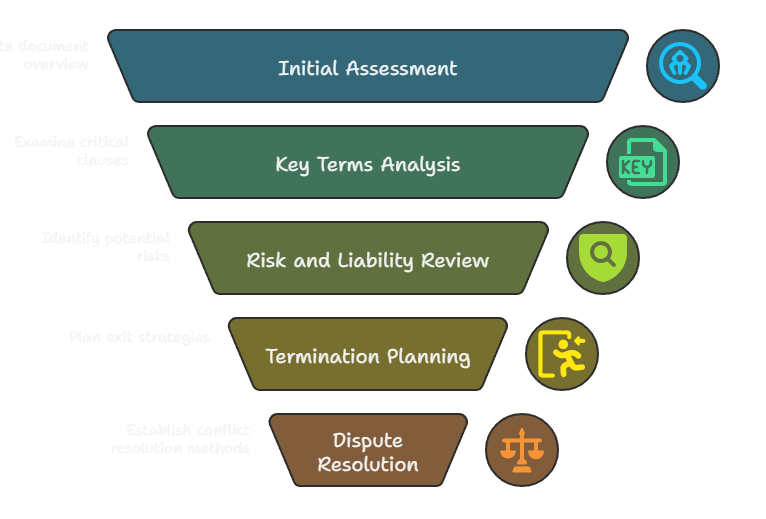

Step-by-Step Contract Review Process

Contract Lawyers follow a systematic approach in their Contract Review Procecss. Whether you’re doing initial review yourself or preparing for a meeting with a contract review lawyer, this process will help you catch important issues.

Step 1: Initial Document Assessment

Start by getting the big picture. Don’t dive into individual clauses yet, instead, understand what type of contract you’re dealing with and its overall structure.

Identify the contract type: Is this a service agreement, employment contract, partnership deal, or licensing agreement? Each type has standard elements you should expect to see.

Check for completeness: Make sure all pages are included, signatures lines are present, and referenced attachments or exhibits are provided.

Note the parties involved: Verify that all parties are correctly identified with proper legal names and addresses. Mistakes here can make contracts unenforceable.

Review the effective dates: When does the contract start and end? Are there automatic renewal clauses you need to be aware of?

Step 2: Key Terms Analysis

Now focus on the core business terms that directly impact your operations and finances.

Scope of work or services: What exactly are you agreeing to deliver or receive? Vague descriptions lead to disputes later. Look for specific deliverables, timelines, and quality standards.

Payment terms: When and how will payment occur? Are there penalties for late payment? What happens if payment is disputed? These clauses directly affect your cash flow.

Performance standards: What metrics will be used to measure success? Who determines if standards are met? Unrealistic or subjective standards can put you at a disadvantage.

Intellectual property rights: Who owns work products, innovations, or improvements created during the contract period? This is especially crucial for creative or technical services.

Step 3: Risk and Liability Review

This is where many business owners get into trouble. Risk and liability clauses determine who pays when things go wrong.

Limitation of liability: Does the contract cap how much you might owe if something goes wrong? Or does it leave you exposed to unlimited damages?

Indemnification clauses: These require one party to cover the other’s legal costs and damages in certain situations. Make sure you understand what you’re agreeing to protect the other party from.

Insurance requirements: Some contracts require specific insurance coverage. Check if your current policies meet these requirements or if you’ll need additional coverage.

Force majeure provisions: These “act of God” clauses excuse performance during events like natural disasters or pandemics. Make sure the definition is reasonable and applies fairly to both parties.

Step 4: Termination and Exit Planning

Understanding how to get out of a contract is just as important as understanding how to fulfill it.

Termination triggers: What events allow either party to end the contract early? Can you terminate for convenience or only for specific causes?

Notice requirements: How much advance notice is required for termination? Is it the same for both parties?

Post-termination obligations: What happens to confidential information, work products, or ongoing responsibilities after the contract ends?

Survival clauses: Some obligations continue even after contract termination. Know which ones survive and for how long.

Step 5: Dispute Resolution Mechanisms

Every contract should address what happens when parties disagree.

Governing law: Which state’s laws will apply if there’s a dispute? This can significantly impact your rights and obligations.

Dispute resolution method: Will disputes go to court, arbitration, or mediation? Each has different costs, timeframes, and procedures.

Attorney fees provisions: Who pays legal costs if there’s a dispute? Some contracts require the losing party to pay everyone’s attorney fees.

Jurisdiction and venue: Where will legal proceedings take place? Being forced to litigate far from home adds significant costs.

When you’re working through this process, don’t hesitate to make notes about terms you don’t understand or clauses that seem unfair. A qualified contract review lawyer can address these concerns and suggest modifications during negotiations.

Common Contract Review Mistakes That Cost Businesses

Even careful business owners make mistakes during contract review. Here are the most common ones and how to avoid them.

Mistake 1: Focusing Only on Price and Ignoring Terms

Many business owners zero in on the dollar amounts and skim over everything else. This tunnel vision can be expensive.

The problem: You might get a great price but terrible terms. Maybe the payment schedule hurts your cash flow, or the liability clauses expose you to massive risk.

The solution: Evaluate the total deal, not just the price. A slightly higher price with better terms often provides more value than a low-price contract with hidden risks.

Mistake 2: Assuming Standard Contracts Are Always Fair

Just because a contract is presented as “standard” or “industry standard” doesn’t mean it’s balanced or fair to your business.

The problem: The other party’s standard contract was written to protect their interests, not yours. They have no incentive to include terms that favor you.

The solution: Every contract is negotiable until you sign it. Don’t be afraid to propose changes or ask for explanations of terms you don’t understand.

Mistake 3: Rushing Through the Review Process

Business moves fast, and there’s pressure to close deals quickly. But rushing contract review almost always backfires.

The problem: Speed kills thoroughness. When you’re in a hurry, you miss important details that could cause problems later.

The solution: Build contract review time into your deal timeline. If the other party won’t allow reasonable review time, that’s a red flag about how they’ll handle the business relationship.

Mistake 4: Not Considering Future Business Changes

Business owners often review contracts based on their current situation without thinking about how their business might evolve.

The problem: A contract that works today might become a straightjacket as your business grows or changes direction.

The solution: Consider how contract terms might affect your business in different scenarios. What if you want to expand into new markets, hire more employees, or offer additional services?

Mistake 5: Ignoring Industry-Specific Risks

Every industry has unique contract risks that general business knowledge doesn’t cover.

The problem: A contract clause that’s harmless in one industry could be devastating in another. For example, data security requirements that are reasonable for a consulting firm might be impossible for a small retailer to meet.

The solution: Understand your industry’s specific contract risks or work with a contract review lawyer who has experience in your field.

Mistake 6: Not Reading the Fine Print

It sounds obvious, but many business owners sign contracts without reading every section, especially the small-print portions at the end.

The problem: Important terms are often buried in boilerplate language. Automatic renewal clauses, choice of law provisions, and dispute resolution procedures are commonly found in the fine print.

The solution: Read everything, even if it seems boring or standard. If you don’t understand something, ask for clarification or get professional help.

Mistake 7: Failing to Document Contract Modifications

Contracts often change during negotiations, but business owners sometimes forget to get modifications in writing.

The problem: Verbal agreements don’t override written contract terms. If you agree to changes during negotiations but don’t update the written contract, you’ll be bound by the original terms.

The solution: Every contract change should be documented in writing and signed by both parties before you sign the main agreement.

These mistakes are exactly why many successful business owners establish relationships with contract review lawyers they trust. Having professional backup for important agreements isn’t a luxury, it’s a smart business investment.

When to Hire a Contract Review Lawyer

Not every contract requires professional legal review, but many business owners either over-rely on lawyers for simple agreements or under-utilize them for complex deals. Here’s how to find the right balance.

High-Stakes Contracts That Always Need Professional Review

Some contracts are too important to handle without expert help. The potential consequences of mistakes far outweigh the cost of professional review.

Partnership and joint venture agreements: These create long-term business relationships with shared profits, losses, and decision-making authority. The legal and financial implications are complex and far-reaching.

Major supplier or vendor contracts: If a contract represents a significant portion of your business expenses or revenue, professional review is essential. This includes exclusive dealing arrangements or long-term supply agreements.

Employment contracts for key personnel: Executive employment agreements, contracts with non-compete clauses, or agreements involving equity compensation need careful review to protect both your business and your employees.

Real estate transactions: Whether buying, selling, or leasing commercial property, real estate contracts involve substantial financial commitments and complex legal requirements.

Licensing and intellectual property agreements: Contracts involving patents, trademarks, copyrights, or trade secrets require specialized knowledge to protect your intellectual property rights.

International contracts: Deals involving parties in different countries bring additional complexity around governing law, currency, dispute resolution, and regulatory compliance.

Medium-Risk Contracts Where Professional Review Depends on Circumstances

For these contracts, the decision to hire a contract review lawyer depends on factors like contract value, your experience with similar agreements, and your risk tolerance.

Service provider agreements: If you’re hiring contractors for specialized services or agreeing to provide services outside your normal business scope, professional review can help identify potential problems.

Technology and software contracts: Software licensing, cloud service agreements, and technology consulting contracts often contain complex terms around data security, intellectual property, and service level agreements.

Franchise agreements: These involve ongoing relationships with specific operational requirements and fee structures that benefit from professional evaluation.

Insurance contracts: While insurance policies are generally standardized, coverage for unique business risks or high-value policies warrant professional review to ensure adequate protection.

Low-Risk Contracts You Can Likely Handle Yourself

Simple, short-term contracts with limited financial exposure can often be reviewed without professional help, especially if you have experience with similar agreements.

Standard purchase orders: Routine purchases of goods or services with familiar suppliers typically don’t require legal review.

Simple service agreements: Basic contracts for common services like cleaning, maintenance, or simple consulting work are usually straightforward.

Membership agreements: Joining trade associations, business organizations, or subscription services rarely involves complex legal issues.

Conclusion: Protecting Your Business Through Smart Contract Review

Contract review isn’t just a legal formality, it’s one of the most important business skills you can develop. Every contract you sign shapes your business relationships, allocates risks, and creates opportunities or limitations that can last for years.

The businesses that thrive are those that treat contracts strategically. They understand that spending time and money on proper contract review is an investment in their future success, not an unnecessary expense. They know when to handle contracts internally and when to call in professional help. Most importantly, they never let the pressure to close deals quickly override the need for careful contract evaluation.

Remember these key principles as you handle contracts in your business:

Every contract is negotiable until you sign it. Don’t accept unfavorable terms just because they’re in the other party’s standard agreement. Most businesses expect some back-and-forth during contract negotiations.

When in doubt, get professional help. The cost of hiring a contract review lawyer for important agreements is almost always less than the cost of contract problems later. A few hundred dollars in legal fees can save you thousands in disputes or missed opportunities.

Build contract review into your business processes. Don’t treat contract evaluation as an afterthought or something to rush through. Good contract review takes time, but it’s time well spent.

Learn from every contract experience. Whether you handle review internally or work with professionals, pay attention to common issues and successful negotiation strategies. This knowledge makes you more effective in future contract situations.

Your business relationships are only as strong as the contracts that govern them. Suppliers who seemed reliable can disappear overnight. Clients who promised steady work can change direction without warning. Partners with great intentions can disagree about fundamental business issues. Well-written contracts protect you when these situations arise.

The contract review process we’ve outlined, from initial assessment through industry-specific considerations, provides a framework for protecting your business. But frameworks are only useful if you apply them consistently. Make contract review a priority in your business, invest in the skills and relationships you need to do it well, and never sign agreements that you don’t fully understand.

Your business’s future depends on the contracts you sign today. Make sure those agreements support your goals, protect your interests, and position you for the success you’re working to achieve.

Ready to Protect Your Business with Professional Contract Review?

Don’t let poorly reviewed contracts put your business at risk. Whether you’re dealing with a complex partnership agreement, negotiating with a major supplier, or just want peace of mind about important business contracts, professional legal guidance can save you time, money, and stress.

Contact My Legal Pal today for expert contract review and revision services tailored to your business needs. Our experienced attorneys understand the challenges facing modern businesses and provide practical, cost-effective contract review that protects your interests while supporting your growth goals.

Get the professional contract review your business deserves. Your future success depends on the agreements you sign today, make sure they’re working in your favor.